Project Frame Methodology

Evaluating Greenhouse Gas Impact for Early-Stage Investments Executive Summary

Project Frame is a community of investors committed to supporting the best possible climate solutions in an effort to mitigate the worst consequences of the climate crisis. We collaborate to build consensus around forward-looking emissions impact methodology and reporting best practices.

In 2023, Project Frame released the first iteration of its methodological guidance, Pre-Investment Considerations: Diving Deeper Into Future Greenhouse Gas Impact—the work of 45 leading climate investors and thought leaders. As of October 2024, this work has been viewed more than 7,500 times, including over 1,200 downloads. This methodological framework has also been embedded into emissions impact assessment tools, such as CRANE and MoreScope, to make it easier for companies and investors to understand the impact potential of climate solutions and make smarter decisions.

However, Frame recognizes that forward-looking emissions impact assessment is a fast-evolving field, with new needs and best practices constantly emerging. To address evolutions in thinking that have occurred since its publication, Frame has updated its methodology. The most notable update includes a refined equation for calculating GHG impact and adjusted GHG impact. This change encourages investors clearly articulate the weight that certain optional variables, such as rebound effects or attribution, hold in their decision-making processes.

While Project Frame’s Content Working Group, comprised of investors and thought leaders with a variety of perspectives and expertise, guide our work, we are not always able to reach consensus. In such cases, we rely on a focus group to help determine best practice. We are grateful to those who provide critical feedback that allows us to push forward.

The impacts of climate change are happening here and now, and we know that we must rapidly and carefully deploy capital to solutions that have real potential to secure a livable planet. Project Frame’s values of transparency and accountability motivate us to create resources that facilitate science-backed climate investing and encourage conversation around where we can do better for our planet and its people.

Project Frame is not a regulatory body, nor should its content be considered financial advice. Methodology guidance produced by Project Frame represents our contributors’ consensus and no one singular entity. Our work is intended for readers to review and use their best judgment to accelerate GHG mitigation with transparency and accountability.

Key Takeaways

Core Equation for Calculating GHG Impact

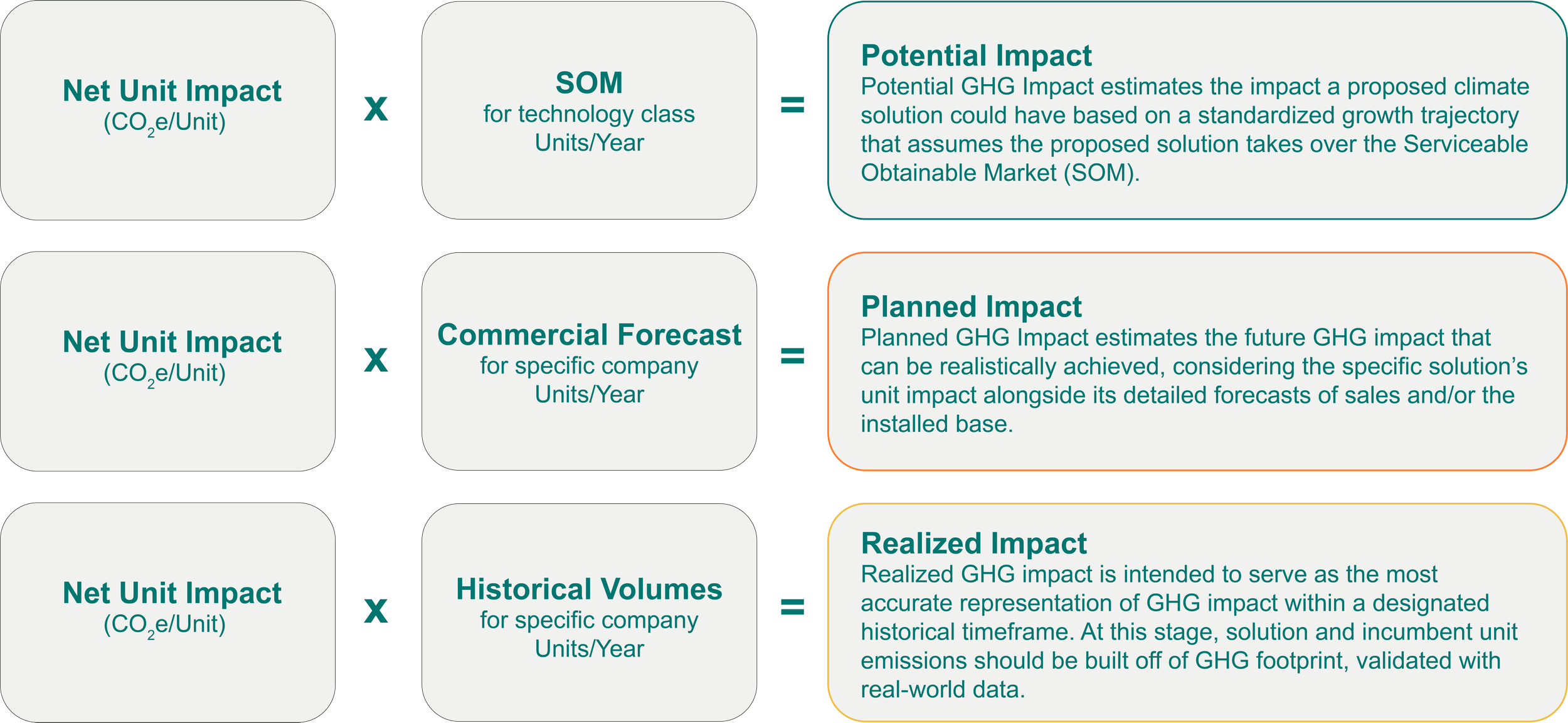

Project Frame’s approach to quantifying GHG impact is anchored in a core equation; unit impact is multiplied by volume to produce GHG impact, which can then be multiplied by optional adjustment factors to produce adjusted GHG impact.

This equation is used for each of our three types of analyses: potential impact, planned impact, and realized impact. Each serves a distinct purpose and requires a different amount of information, often depending on a solution or company’s stage and the availability of a detailed sales forecast or historical data.

Using Solution Effects to Quantify Net Unit Impact

Net unit impact is the overall difference in GHG emissions when comparing a solution to its incumbent counterpart over a specified period of time. There are many factors, positive and negative, that contribute to differences in GHGs and may occur at any life cycle of the solution.

For efficient decision-making, Frame encourages analysts to use a five-step process to narrow down which factors, also known as solution effects, to consider in their assessments:

List each solution effect, or the source of difference in emissions between the solution and incumbent

Analyze associated incumbent emissions

Analyze associated solution emissions

Qualitatively compare solution and incumbent emissions today and in the future using estimates.

Assess for materiality to determine if the difference in emissions is substantial enough to carry it forward to detailed quantification.

GHG Impact Types

Potential GHG impact estimates the impact a proposed climate solution could have based on a standardized growth trajectory that assumes the proposed solution takes over the Serviceable Obtainable Market (SOM). This analysis is valuable for early-stage solutions that could alter emissions patterns and is most applicable when looking at those with limited information. Potential impact analyses are longer-term, such as 2040 or 2050, and often align with global scenarios, by the International Energy Agency (IEA).

Planned GHG impact estimates the future GHG impact that can be realistically achieved, considering the specific company’s unit impact alongside its detailed sales forecasts. It is more applicable to companies with realistic business plans that reflect specific market segments and incorporate fleet effects for solutions with long operational lifespans. Planned impact analyses typically align with timeframes established by business plans, such as 7-10 years.

Realized GHG impact is intended to serve as the most accurate representation of GHG impact within a designated historical timeframe. At this stage, solution and incumbent unit emissions should be built off of GHG footprint, validated with real-world data. It is calculated by multiplying the most up-to-date measure of unit impact by historical volumes, such as sales and/or the installed base, assuming sales have occurred.

Applying Optional Adjustment Factors

The core equation includes variables that directly affect a solution’s GHG impact. Adjustment factors, however, are separate yet important variables that can influence an investor’s decision-making process. Project Frame does not explicitly recommend the practice of attribution, but providing a framework for investors who choose to pursue it.

REBOUND EFFECTS

Rebound effects are quantifiable ways in which a solution may influence consumer or market behaviors, indirectly affecting GHG impact. Examples include how a solution may influence the use or sale of separate products, services, or markets, or result in a change in how or how much the solution is used relative to the incumbent(s).

ATTRIBUTION

Project Frame periodically updates its glossary to ensure that the terminology used reflects the needs and best practices. Value Chain Attribution Adjustment, defined as attributing portions of emissions reduction impact across contributors along the value chain, has been renamed from horizontal attribution, and Capitalization Attribution Adjustment, which aims to apportion GHG impact or carbon footprint among the respective owners, has been renamed from vertical attribution.

Additionality

Additionality is among the most debated topics, in part for its subjectivity. Today, Frame does not provide specific methodological guidance. Instead, our goal is to develop a common language within the Frame community that enables investors to advance their strategic approach. Project Frame has updated its definition of additionality to read:

An attribute of impact requiring an investor or company’s thoughtful and reasonable articulation of the degree to which its support causes a change in an outcome that would have not otherwise happened (in a no-intervention or business as usual baseline scenario).

Frame currently describes two classes and associated sub-classes of additionally: investor-level, which includes financial additionality and value add additionality, and enterprise-level, which includes performance additionally and adoption additionality.

What’s Next

Case Studies

Project Frame will continue expanding its library of case studies, which are developed to advance the practice of forward-looking emissions impact assessment by showcasing how Frame’s methodology can be applied to a range of climate solutions.

Inspired by real investments, these case studies lift the veil on challenges analysts face during the assessment process and encourage readers to explore where analysis can go deeper for smarter climate investing.

Expanding Methodology for Later Stages

To better serve investors supporting climate solutions, Project Frame will expand its methodology beyond guidance for early-stage companies and investors.

Frame’s objective is to ensure that all—regardless of asset class, maturity or industry—can navigate best practices for forward-looking emissions assessment to ensure we are allocating capital towards the most impactful solutions to avoid future and/or unnecessary emissions

Considerations Around Adaptation and Resilience

Project Frame understands that addressing the critical urgency of climate change requires more than mitigating GHG emissions, particularly for those already living with the consequences of the crisis, such as those in the Global South who are disproportionately impacted.

Frame will continue the conversation on considerations around adaptation and resilience to better understand how those co-benefits can be articulated in a structured manner alongside forward-looking emissions impact assessments.

Support Our Work

Project Frame is a nonprofit program convened by Prime Coalition, a nonprofit 501(c)(3), catalytic investor, and co-creator of the CRANE tool.

Project Frame does not accept direct funding from its members. Rather, it operates through grants provided to Prime. We thank those who wish to make a donation to support Prime Coalition’s work and join our shared mission to advance impact accountability in climate investing. Donations by Frame community members will be anonymized to program staff.